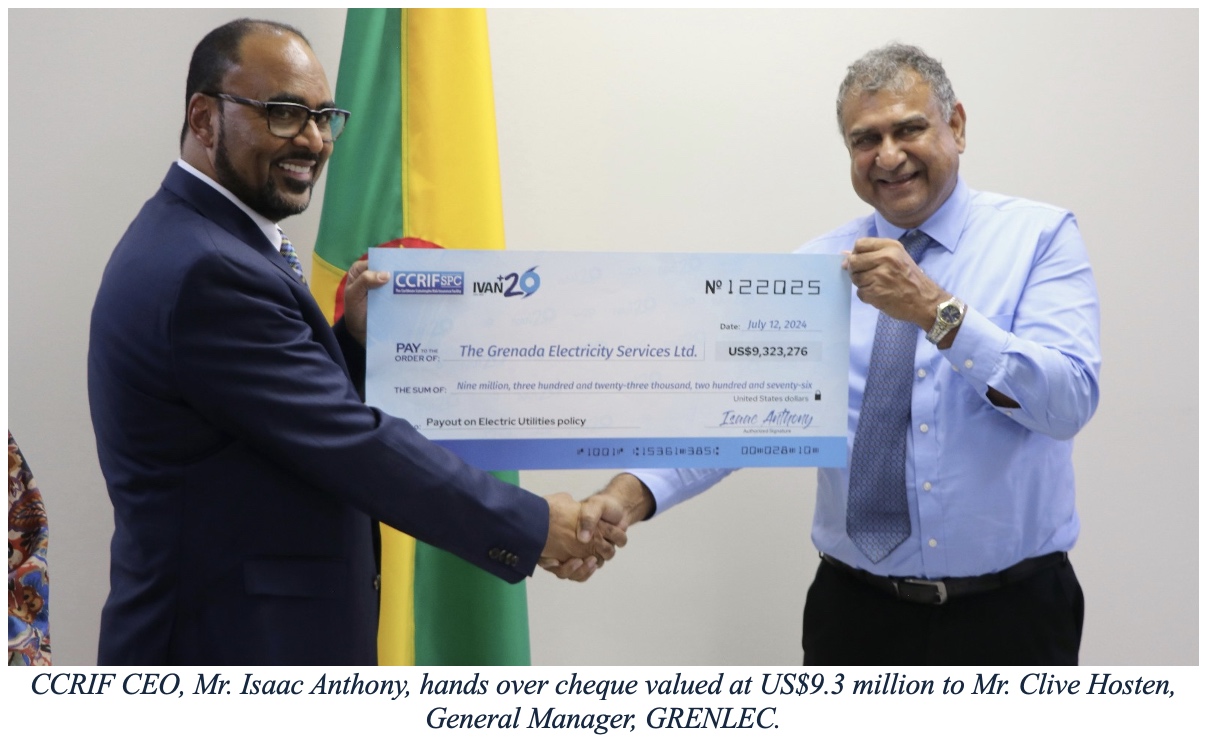

Grenada, July 30, 2024. Grenada Electricity Services Limited (GRENLEC) received an insurance payout of US$9,323,275 (approximately EC$25.1 million) from CCRIF following the passage of Hurricane Beryl. In addition to damage to infrastructure, housing and ecosystems, Beryl also caused damage to Grenada’s electric transmission and distribution systems, which are managed by GRENLEC. GRENLEC became a member of CCRF in 2023, when it purchased CCRIF’s parametric insurance product for electric utilities.

Launched in 2020, CCRIF’s parametric insurance product for electric utilities limits the financial impact of devastating tropical cyclones by quickly providing financial liquidity to electric utility companies when a policy is triggered. The product covers direct damage to the transmission and distribution (T&D) components of electric power systems due to impacts of wind.

The launch of this insurance product for electric utilities enabled CCRIF to expand coverage to non-sovereigns and to the private sector. According to CCRIF CEO, Mr. Isaac Anthony, “The close relationship between wind speed and overhead T&D system damage created the opportunity for CCRIF to develop this innovative parametric insurance product for electric T&D systems, which could be priced much more competitively in the marketplace than traditional indemnity insurance. One of the issues faced by electric utilities in the Caribbean is the inability to access traditional indemnity insurance for overhead T&D systems because of the very limited availability of insurance and uneconomical pricing due to the high risk”.

On receiving the payout, Mr. Clive Hosten, General Manager of GRENLEC, stated that, “GRENLEC is grateful for the timely and crucial financial payout provided by the CCRIF parametric insurance. This funding plays a vital role in our efforts to restore and enhance our electricity infrastructure following the recent passage of Hurricane Beryl. The CCRIF payout has enabled us to expedite repairs, ensuring that essential services are reinstated for the benefit of our community. We commend CCRIF for their efficient and responsive handling of the claim process within 14 days as promised. Their professionalism and speed in disbursing the funds are commendable. The company will also utilize these funds to build essential resilience into our network. Moving forward, we are committed to strengthening our infrastructure against future disasters in an effective manner. We are extremely proud to be the first electric utility in the region to receive a payout from CCRIF”.

The economic losses to utility sectors after hurricanes, mainly due to damage to their T&D systems, are high, and traditionally citizens have borne the brunt of repair costs through increased electricity bills.

The Government of Ireland provided a grant to CCRIF for the development of this product, which was undertaken in close collaboration with the Caribbean Electric Utility Services Corporation (CARILEC). CARILEC is an association of electric utilities, suppliers, manufacturers and other stakeholder operations in the electricity industry in the Caribbean where 35 of its members are electric utilities. At the launch of the product in 2020, CARILEC’s Executive Director, Dr. Cletus Bertin, stated that “The role of electricity in the economic and social life of the region is pivotal. This product is not just for the electric utilities sector. It is for the development of the region in terms of the economic and social life of the people, who are dependent on tourism as well as agri-business, light manufacturing, etc., which are all reliant on the steady supply of electricity. The product speaks to a broader agenda: our ability to bounce back quickly after a disaster and generate economic activity through the provision of electricity to the industrial and commercial sector”.

Three electric utilities in the Caribbean currently have electric utilities policies with CCRIF: GRENLEC, as well as ANGLEC (Anguilla) and LUCELEC (Saint Lucia). CCRIF is actively engaged with other electric utility companies in developing the product for them. ANGLEC has been purchasing the product since its launch in 2020, based on the utility’s experience with Hurricane Irma in 2017, three years earlier. In 2017, the utility was severely impacted by Hurricane Irma and almost all of its transmission and distribution network was destroyed, costing the company in excess of EC$40 million to restore (US$15 million). At the time, the company had EC$16 million in its reserves or self-insurance fund. After Irma, all its reserves were used up. Today with the increasing frequency, intensity and unpredictability of climate-related events, the CCRIF CEO is reminding utilities that “whilst having in place reserve funds for disasters and engaging in self-insurance will also be useful, one major event could wipe out those reserves. Insurance, and indeed parametric insurance, ought to be viewed as a key component of utility companies’ risk management and financial sustainability frameworks”.

CCRIF is currently in active conversation with several other electric utility companies in the Caribbean to access this product. For additional information on the electric utilities product, visit the CCRIF webpage at:

https://www.ccrif.org/publications/booklet/ccrif-spc-electric-utilities-product

Following Hurricane Beryl, the Government of Grenada received payouts totalling US$44 million on its tropical cyclone, excess rainfall and COAST (fisheries) policies. In keeping with CCRIF’s value proposition, all payouts were made within 14 days of the event to allow the country to begin recovery efforts.

CCRIF currently offers 6 parametric insurance products, providing coverage for tropical cyclones, earthquakes, excess rainfall, and for the electric and water utility and fisheries sectors. CCRIF has 30 members: 19 Caribbean governments, 4 Central American governments, 3 electric utility companies, 3 water utility companies, and 1 tourist attraction.

Parametric insurance products are insurance contracts that make payments based on the intensity of an event (for example, hurricane wind speed, earthquake intensity, volume of rainfall) and the amount of loss calculated in a pre-agreed model caused by these events. Therefore, payouts can be made very quickly – and in the case of CCRIF, within 14 days after a hazard event. This is different from traditional or indemnity insurance that require an on-the-ground assessment of individual losses after an event before a payout can be made.

About CCRIF SPC:

CCRIF SPC is a segregated portfolio company, owned, operated, and registered in the Caribbean. It limits the financial impact of catastrophic hurricanes, earthquakes, and excess rainfall events to Caribbean and Central American governments by quickly providing short-term liquidity when a parametric insurance policy is triggered. It is the world’s first regional fund utilising parametric insurance, giving member governments the unique opportunity to purchase earthquake, hurricane and excess rainfall catastrophe coverage with lowest possible pricing. CCRIF offers parametric insurance policies to Caribbean and Central American governments for tropical cyclones, earthquakes, excess rainfall and fisheries and also to electric and water utility companies in the Caribbean. CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, the Central America and Caribbean Catastrophe Risk Insurance Program (CACCRIP) MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and potential members and facilitate the entry of Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including Canada, through Global Affairs Canada; the United States, through the Department of the Treasury; the European Union, through the European Commission, and Germany, through the Federal Ministry for Economic Cooperation and Development (BMZ) and KfW. Additional financing has been provided by the Caribbean Development Bank (CDB), with resources provided by Mexico; the Government of Ireland; and the European Union through its Regional Resilience Building Facility managed by the Global Facility for Disaster Reduction and Recovery (GFDRR) and the World Bank. In 2024, CCRIF received funding from CDB, through the Canada-CARICOM Climate Adaptation Fund, to enable seven CCRIF members to increase their coverage and make their national social protection systems more shock responsive.

For more information about CCRIF SPC: Website: www.ccrif.org | Email: pr@ccrif.org

Tag us:

Twitter: @ccrif_pr

Facebook: @ccrif.org

Instagram: ccrif_spc

LinkedIn: @ccrif spc

YouTube: https://youtube.com/@ccrifspc75

#ccrifspc #caribbean #grenada #grenlec #payout #beryl #naturaldisaster #catastropheriskinsurance #disasterriskfinancing #parametricinsurance #climatechange #lossanddamage #US$9million #transmissionanddistrubution #electricutilities #carilec #T&D #insurancefortransmissionanddistribution