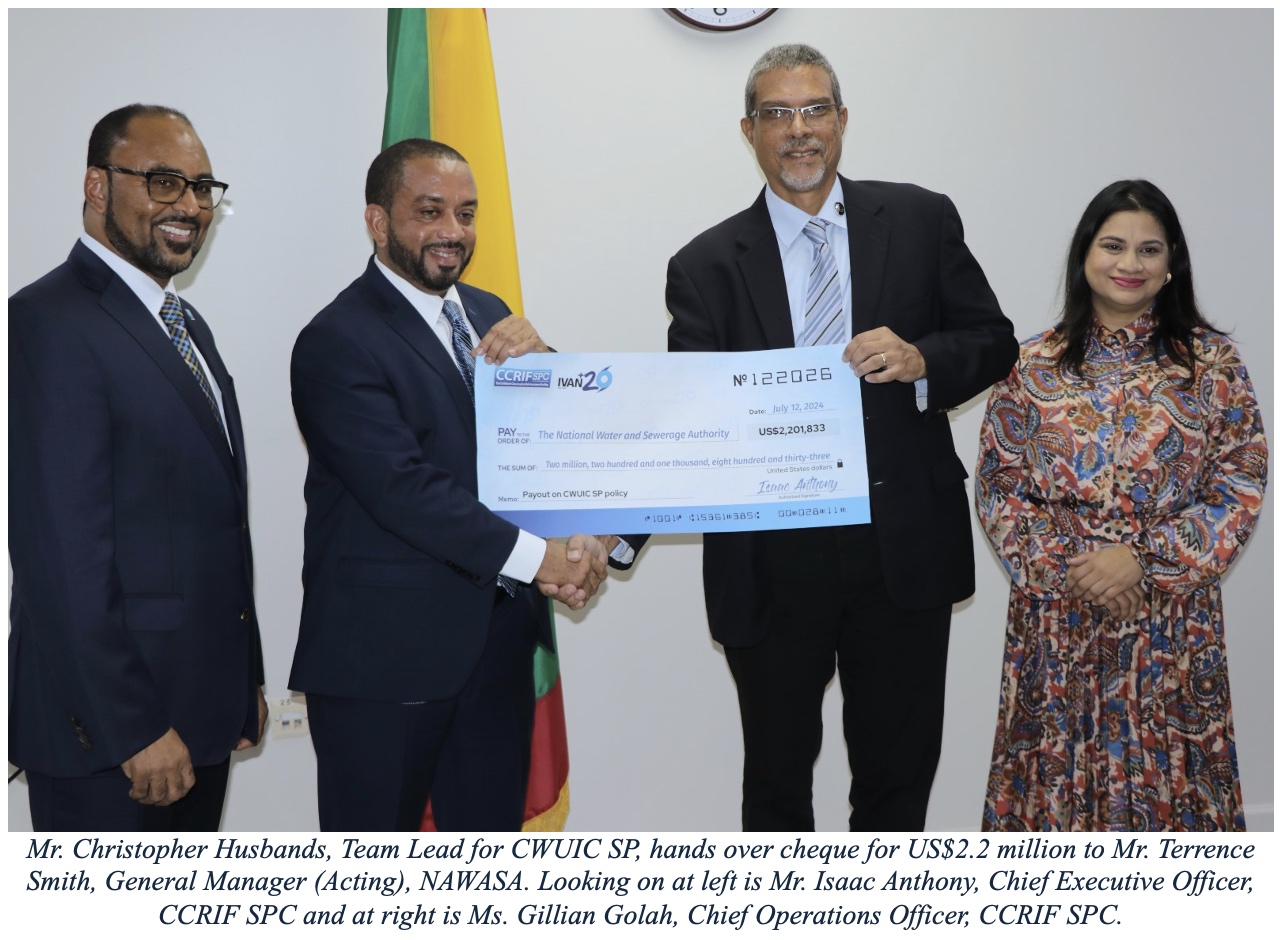

Grand Cayman, Cayman Islands, July 23, 2024. The National Water and Sewerage Authority (NAWASA) of Grenada received US$2,201,833 (EC$5.9 million) following the passage of Hurricane Beryl across the country on July 1, 2024, causing damage to water and wastewater systems in Grenada and the islands of Carriacou and Petite Martinique.

On hearing of the payout to NAWASA, Mr. Malcolm Geere, Development Director for the United Kingdom (UK) in the Caribbean, said: “I am delighted that Grenada’s National Water and Sewerage Authority (NAWASA) has received this payout from the Caribbean Water Utilities Insurance Collective Segregated Portfolio (CWUIC SP) to help restore vital clean water supplies to households in Carriacou and across the country affected by Hurricane Beryl. The UK’s support to CWUIC SP is part of our long-term investment in building financial and climate resilience in Caribbean countries. We congratulate NAWASA, as well as the Dominica Water and Sewerage Company Limited (DOWASCO) and Belize Water Services (BWS), for being the first utilities to take out insurance through CWUIC SP and encourage other water and wastewater utilities across the region also to protect the resilience of their services with insurance and advice from CWUIC SP”.

In September 2023, CCRIF, in collaboration with the Inter-American Development Bank (IDB); the UK Foreign, Commonwealth and Development Office (FCDO); and the Caribbean Development Bank (CDB), launched the Caribbean Water Utility Insurance Collective (CWUIC), which has been established as a segregated portfolio (SP) within CCRIF. According to CCRIF CEO, Mr. Isaac Anthony, “One of the benefits of CCRIF’s segregated portfolio structure is its ability to provide solutions to various economic sectors as they seek to manage their disaster risk. We are pleased to house CWUIC SP within CCRIF to provide a comprehensive solution to the water and wastewater sector in the Caribbean to build climate and financial resilience, including the provision of a multi-peril parametric insurance product, further underscoring CCRIF’s role as a leading development insurer”.

CWUIC SP has been designed to build resilience and financially protect water utilities in the Caribbean against the impacts of extreme weather events such as hurricanes, tropical storms, and excess rainfall. Cover is available to all water/wastewater utilities in the Caribbean, and three water utilities – NAWASA (Grenada), DOWASCO (Dominica) and BWS (Belize) – joined CWUIC SP on June 1, 2024, and purchased coverage for the first time.

Mr, Terrence Smith, General Manager (Acting), NAWASA, shared his experience with joining CWUIC SP, recommending that other water utilities consider parametric insurance as a means of mitigating the increasing risks that climate change poses. “I consider NAWASA to be extremely fortunate to have moved in a timely and expeditious manner to conclude our negotiations with CCRIF to sign on to this parametric insurance, mere weeks before the passage of Hurricane Beryl. It was very reassuring receiving an email from CCRIF on Sunday 30th June, the day before Hurricane Beryl hit Grenada, assuring us that even though we had not yet paid our premium we were covered. I urge our sister water utilities in the region to participate in CWUIC - it is a sure-fire method of mitigating the climate risk that hurricanes will continue to present for us in the region. I highly recommend it”.

A total of US$8.8 million of grant resources was mobilized for the establishment of CWUIC SP, including US$8.2 million from the IDB Group, of which US$5.6 million was provided by the UK Government through FCDO to support technical assistance to finalize the structuring of CWUIC SP and provide premium subsidies for the insurance coverage to water utilities in 6 Caribbean countries. The IDB Group has also counted on contributions from two IDB-managed multi-donor trust funds (NDC Pipeline Accelerator Multi-donor Trust Fund, and Multi-donor AquaFund), the Climate Investment Funds, and, most recently, The Coca-Cola Foundation. CDB approved grant funds of US$650,000 in technical assistance. FCDO also provided development aid to CCRIF, in the amount of US$25 million, to capitalize CWUIC SP. This will be used in combination with reinsurance to protect CWUIC SP against unexpected losses from policy claims. This US$25 million facility provided by FCDO to CCRIF is interest free with repayment after a 20-year period.

Mr. O’Reilly Lewis, Acting Director of Projects at the CDB, further commented that, “The Caribbean Development Bank commends the progress CWUIC SP has made in offering customized financial protection and disaster risk transfer solutions to Caribbean water utilities. This first payout is a testament to the tangible benefits we anticipated from our partnership with CCRIF in establishing CWUIC SP. Our ongoing support for CWUIC SP underscores our commitment to enhancing the resilience and self-reliance of the water sector, ensuring water utilities can maintain uninterrupted access to essential water and wastewater services. This effort is part of our broader policy to strengthen national response and recovery efforts in our client countries, as we collaborate with Caribbean governments to transform lives.”

The vision for CWUIC SP goes beyond insurance. It has been designed as a centre of excellence for disaster risk management and financing for water utilities and has 3 components as follows:

- Support to water utilities in emergency response planning and restoring and rebuilding post-disaster.

- Parametric insurance to help water utilities to respond to and recover from natural disasters.

- Provision of advisory services and technical assistance to identify and structure priority projects to build water and wastewater utilities’ resilience to natural hazards.

This payment to NAWASA was made in addition to US$44 million paid to the Government of Grenada on its Tropical Cyclone, Excess Rainfall and COAST (fisheries) policies. CCRIF also made a payout to Grenada’s electric utility company, the Grenada Electricity Services Limited (GRENLEC) under its parametric insurance policy. Total payouts to Grenada amounted to approximately US$55.57 million. The payouts to GRENLEC and NAWASA represent the first payouts made by CCRIF for policies for electric and water utilities since these two products were launched in 2020 and 2023 respectively.

In keeping with CCRIF’s value proposition, all payouts are made within 14 days of the event to allow countries and sectors to begin recovery efforts.

Mr. Sergio Campos, Water and Sanitation Division Chief at the IDB, said, “It is remarkable that CWUIC SP provided this payout to NAWASA within two weeks post-Hurricane Beryl. We are pleased that this will help NAWASA take immediate actions to restore water and sanitation services—not needing to wait longer for financing—as these services are of fundamental importance for the affected communities. We also hope that CWUIC SP, the first risk pool for water utilities, can serve all the utilities in the Caribbean region, at a time when natural disasters of this kind are becoming more frequent and more intense due to climate change. We will continue reaching out to all utilities in the Caribbean and offering this product as part of a broader effort by the IDB Group to improve the resilience of infrastructure services.”

Approximately 35 water utilities in 29 territories in the Caribbean have been identified as potential clients for CWUIC SP and CCRIF and the CWUIC SP team continue to work with several other water utility companies in the Caribbean to access this coverage. The introduction of CWUIC SP is timely, since following natural disasters, the infrastructure and equipment of water utilities such as pumping stations and intake valves may be significantly impacted and/or destroyed, often due to the high levels of turbidity and accompanying flooding. Water utilities across the region have limited financial resources and oftentimes are unable to recover in a timely manner to provide safe drinking water and sanitation services following natural disasters. The importance of potable water following a natural disaster cannot be emphasized enough and is key to avoiding the incidence of water-borne diseases which are often associated with natural hazard events.

About CCRIF SPC:

CCRIF SPC, formerly the Caribbean Catastrophe Risk Insurance Facility, is a segregated portfolio company, owned, operated and registered in the Caribbean. It limits the financial impact of catastrophic hurricanes, earthquakes and excess rainfall events to Caribbean and Central American countries by quickly providing short-term liquidity when a parametric insurance policy is triggered. It is the world’s first regional fund utilizing parametric insurance, giving members the unique opportunity to purchase disaster risk insurance with lowest-possible pricing. CCRIF offers parametric insurance policies to Caribbean and Central American governments for tropical cyclones, earthquakes, excess rainfall and fisheries and also to electric and water utility companies in the Caribbean. CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, the Central America and Caribbean Catastrophe Risk Insurance Program (CACCRIP) MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and potential members and facilitate the entry of Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including Canada, through Global Affairs Canada; the United States, through the Department of the Treasury; the European Union, through the European Commission, and Germany, through the Federal Ministry for Economic Cooperation and Development (BMZ) and KfW. Additional financing has been provided by the Caribbean Development Bank (CDB), with resources provided by Mexico; the Government of Ireland; and the European Union through its Regional Resilience Building Facility managed by the Global Facility for Disaster Reduction and Recovery (GFDRR) and the World Bank. In 2024, CCRIF received funding from CDB, through the Canada-CARICOM Climate Adaptation Fund, to enable seven CCRIF members to increase their coverage and make their national social protection systems more shock responsive.

#ccrifspc #caribbean #grenada #carriacou #nawasa #payout #beryl #naturaldisaster #catastropheriskinsurance #disasterriskfinancing #parametricinsurance #climatechange #lossanddamage #US$2.2million #CDB #IDB #CWUIC #CWUICSP #ukincaribbean #waterutilities #waterwastewater