March 1, 2022, BRIDGETOWN, Barbados and GRAND CAYMAN, Cayman Islands – The Caribbean Development Bank (CDB) and CCRIF SPC will host the 2022 Caribbean Regional Risk Conference on April 6 & 7, to provide a forum for policymakers, senior technocrats, and other stakeholders to explore country risk management and risk governance.

Under the theme, “Introducing Country Risk Management to Advance Sustainable Development”, the event will address the myriad of risks facing Caribbean countries, taking the discussion beyond natural hazard risks and climate change, to explore economic, geopolitical, environmental, societal, and technological risks, which continue to impact the region’s development prospects. Already confirmed speakers and presenters are from several regional and international organizations, including the World Economic Forum, the United Nations, The World Bank, Swiss Re, The University of the West Indies, and PriceWaterhouseCoopers, among others.

The conference will highlight the role of integrated risk management frameworks at the country level in enabling policymakers to better anticipate, identify and manage both climate and non-climate risks. Participants also will be exposed to cutting-edge tools, processes, and governance structures, necessary for operationalizing country risk management and developing all-hazards policy frameworks.

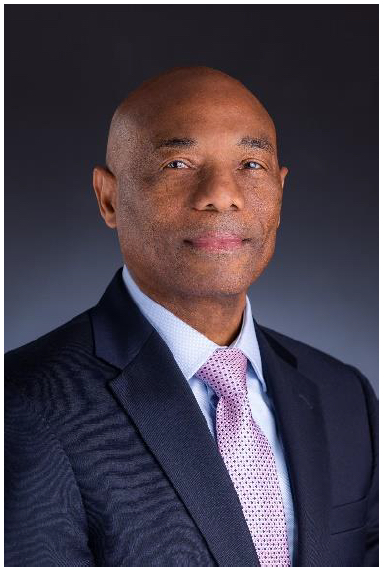

President of the CDB, Dr. Hyginus “Gene” Leon said, “In the wake of the global pandemic and the growing threat of climate change, this conference takes on special significance as it sets the stage for us to explore country risk management through a wider lens and build much-needed capacity amongst key stakeholders. We will leverage the experience of both CDB and CCRIF along with recognized experts to stimulate new policy direction and action.”

President of the CDB, Dr. Hyginus “Gene” Leon said, “In the wake of the global pandemic and the growing threat of climate change, this conference takes on special significance as it sets the stage for us to explore country risk management through a wider lens and build much-needed capacity amongst key stakeholders. We will leverage the experience of both CDB and CCRIF along with recognized experts to stimulate new policy direction and action.”

The Caribbean Regional Risk Conference is part of the Integrated Country Risk  Management in the Caribbean Project, launched by the CDB and CCRIF SPC in 2017 to support the development of a regional risk platform for Caribbean governments.

Management in the Caribbean Project, launched by the CDB and CCRIF SPC in 2017 to support the development of a regional risk platform for Caribbean governments.

In commenting on the conference and the wider country risk management project, CCRIF’s CEO, Mr. Isaac Anthony said, “As we seek to build forward stronger post-COVID and achieve the SDGs, country risk management and integrated risk governance must be seen as a key strategy for Caribbean sustainable development. This initiative will req uire action by a range of partners whose mandates focus on areas outside of natural catastrophe risks – mandates related to economic and financial risks as well as social and other humanity-related risks – to make it a resounding success for the small island and coastal states of the region.”

The conference will be held virtually and is open to the public. The programme will cater to several target groups including the public and private sectors, civil society organizations, development organizations, academia, and the media.

At the end of the conference, CCRIF, CDB and the Caribbean Centre for Development Administration (CARICAD) will launch the Caribbean Integrated Risk Management Training Programme for the Public Sector.

To register for the conference, interested persons can contact CDB at CaribbeanRiskConference@caribank.org or CCRIF at caribbeanriskconference@ccrif.org

Press contacts

About CCRIF SPC:

CCRIF SPC (formerly the Caribbean Catastrophe Risk Insurance Facility) is the world's first multi-country, multi-peril risk pool based on parametric insurance. CCRIF provides parametric catastrophe insurance for Caribbean and Central American governments, and for electric utility companies. CCRIF offers parametric insurance for tropical cyclones, excess rainfall, and earthquakes and for the fisheries and electric utilities sectors – insurance products not readily available in traditional insurance markets. The Facility operates as a developmental insurance company – as the goods and services it provides are designed to enhance the overall developmental prospects of its members. CCRIF has 23 members – 19 Caribbean governments, 3 Central American governments and 1 Caribbean electric utility company. Since its inception in 2007, CCRIF has made 54 payouts totalling US$245 million to 16 of its members. All payouts are paid within 14 days of the event.

CCRIF was developed under the technical leadership of the World Bank and with a grant from the Government of Japan. It was capitalized through contributions to a Multi-Donor Trust Fund (MDTF) by the Government of Canada, the European Union, the World Bank, the governments of the UK and France, the Caribbean Development Bank and the governments of Ireland and Bermuda, as well as through membership fees paid by participating governments. In 2014, a second MDTF was established by the World Bank to support the development of CCRIF SPC’s new products for current and potential members and facilitate the entry of Central American countries and additional Caribbean countries. The MDTF currently channels funds from various donors, including: Canada, through Global Affairs Canada; the United States, through the Department of the Treasury; the European Union, through the European Commission, and Germany, through the Federal Ministry for Economic Cooperation and Development and KfW. Additional financing has been provided by the Caribbean Development Bank, with resources provided by Mexico; the Government of Ireland; and the European Union through its Regional Resilience Building Facility managed by the Global Facility for Disaster Reduction and Recovery (GFDRR) and The World Bank.

About the Caribbean Development Bank

The Caribbean Development Bank is a regional financial institution established in 1970 for the purpose of contributing to the harmonious economic growth and development of its Borrowing Member Countries (BMCs). In addition to the 19 BMCs, CDB’s membership includes four regional, non-borrowing members (Brazil, Colombia, Mexico and Venezuela) and five non-regional, non-borrowing members (Canada, China, Germany, Italy, and the United Kingdom). CDB’s total assets as at December 31, 2020 stood at US$3.64 billion (bn). These include US$2.12 bn of Ordinary Capital Resources and US$1.52 bn of Special Funds Resources. The Bank is rated Aa1 Stable by Moody’s, AA+ Stable by Standard & Poor’s and AA+ Negative by Fitch Ratings. Read more at caribank.org